Published on July 19, 2021

What is an ATM Offering?

An ATM program allows a public company to raise capital over time by offering securities into the already existing trading market. The company sells newly issued shares periodically, over time, on an as-needed basis based on the current trading price of the securities.

Why would a company use an ATM Offering?

- Raise capital by selling stock into natural trading volume of the market

- Often effective whenever or not the market is receptive to other types of offerings

- Flexibility in terms of commitment and use

- Not designed for a fixed amount of shares, but a fixed amount of capital

Comparison to Traditional Follow-on Offering

At-the-Market Offering

- A continuous offering

- Shares are dribbled out

- Sold on an agency basis through one or more distribution agents; may be sold on a principal basis

- Issuer determines amount, floor price, and duration of any issuance

- Amounts, floor prices, and duration of placements may vary over the life of the program, and can be changed at any time

Follow-on Offering

- A "bullet" or single offering

- Shares are sold all at once

- Sold as principal through a syndicate of underwriters

- The clearing price and size of issuance is based on investor demand at a specific point in time

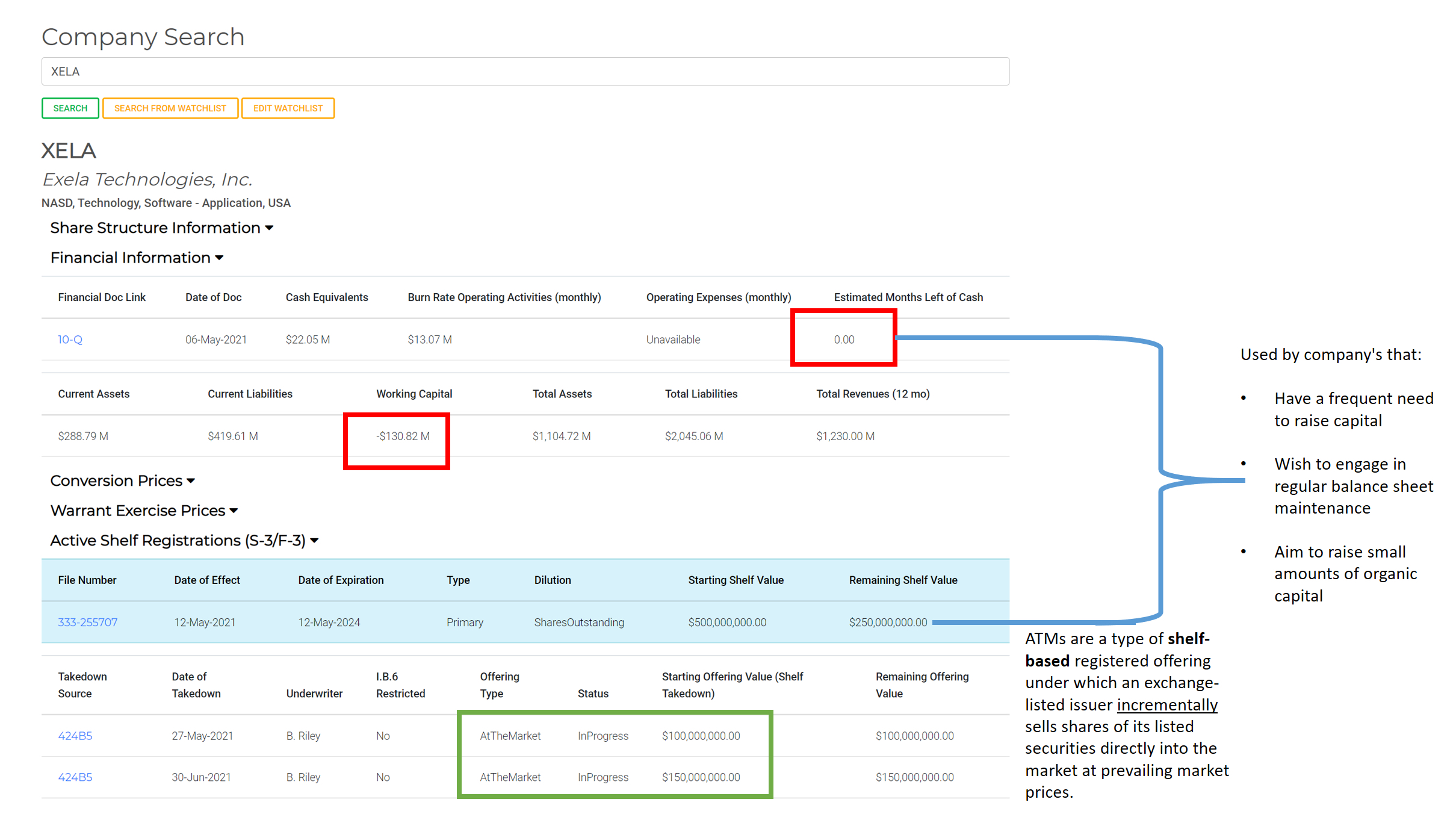

Identifying an ATM Offering in FlashSEC

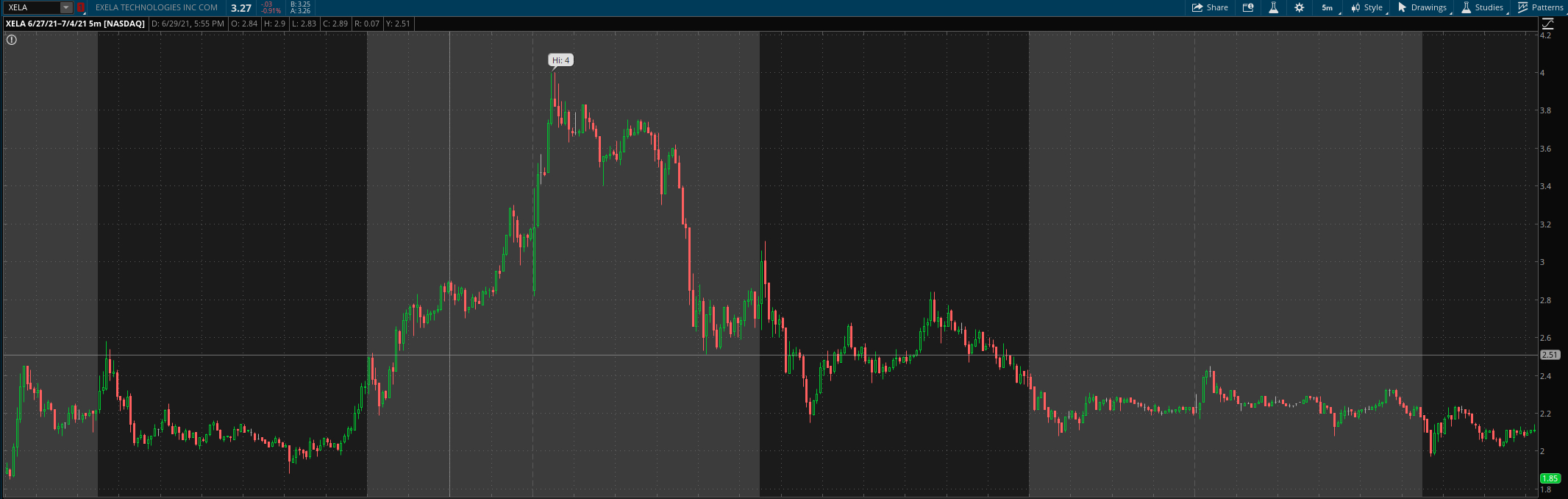

Impact of ATM on Price Action

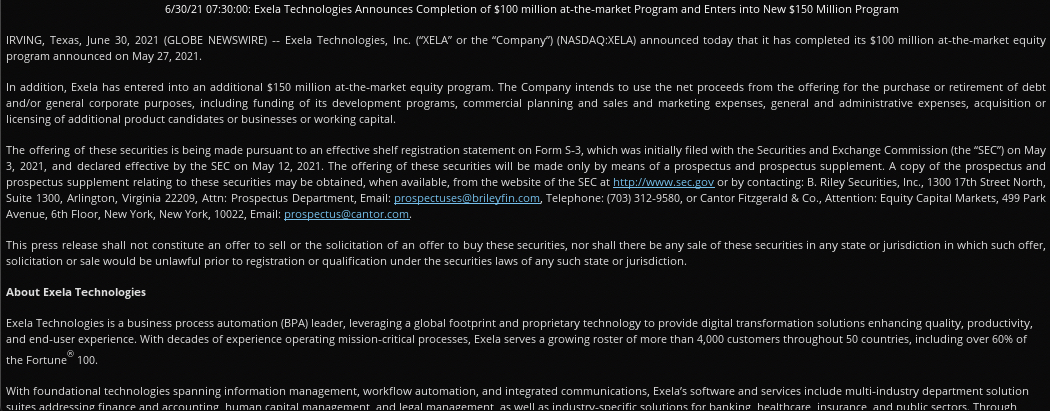

$XELA saw a 40% decrease off of its highs when the ATM offering was triggered on 30-Jun-2021 due to an increase of supply increasing both outstanding shares and float.