Published on October 21, 2021

Background on Convertible Debt

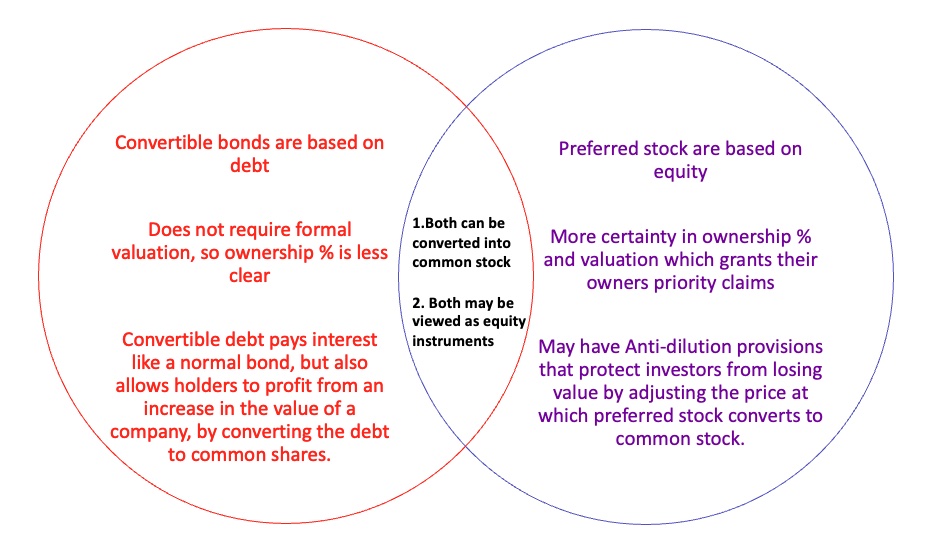

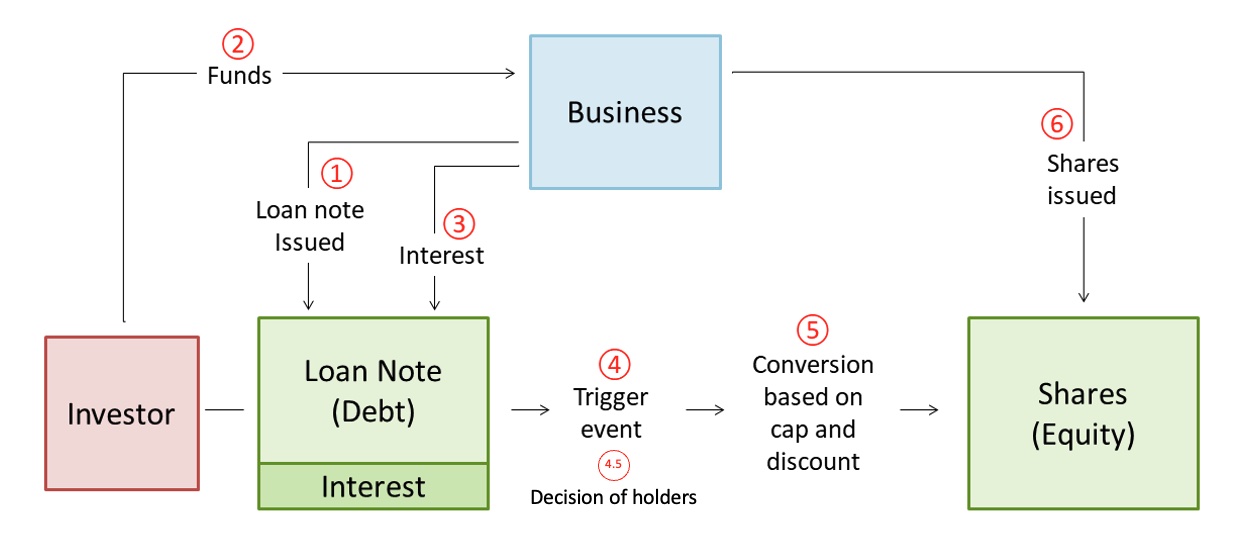

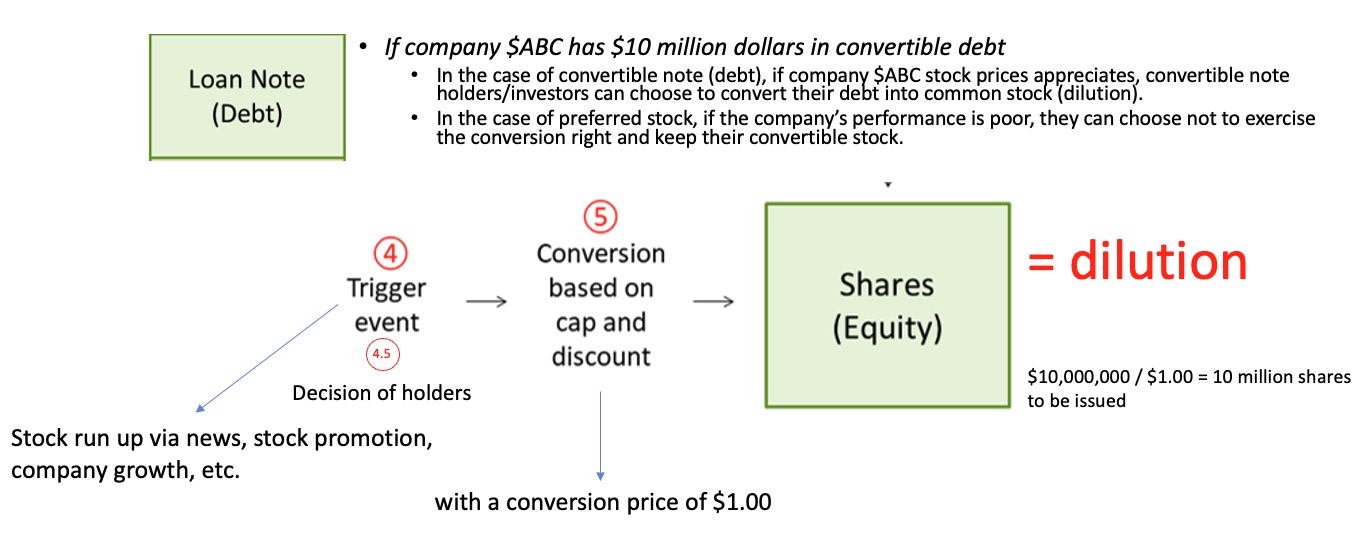

Convertible debt is a common investment vehicle by which early-stage companies raise capital. This is in the form of a short term loan granted from a investor to a company. What makes this loan unique is that the loan can convert into equity of the company at a future date (next priced funding round). In return, the investors receive compensation at the time that the debt converts to equity (dilution).

Typically convertible debt offers interest at a lower rate than straight debt instruments.

A company's total liabilities are the combined debts and obligations that a company owes to outside parties. Everything the company owns is classified as an asset and all amounts the company owes for future obligations are recorded as liabilities.

Background on Convertible Preferred Stock

Convertible preferred stocks are preferred shares (dividend paying) that include an option for the holder to convert the shares into a fixed number of common shares after a predetermined date. These details are covered in the convertible preferred stock agreements, which specify the conversion ratio from preferred to common shares.

Each agreement is unique and may have a different conversion ratio. For example, convertible preferred stock may be exchanged at the request of the shareholder into common stock. However, sometimes there is a provision that allows the company, or issuer, to force the conversion.

What is a convertible note and who invests in them?

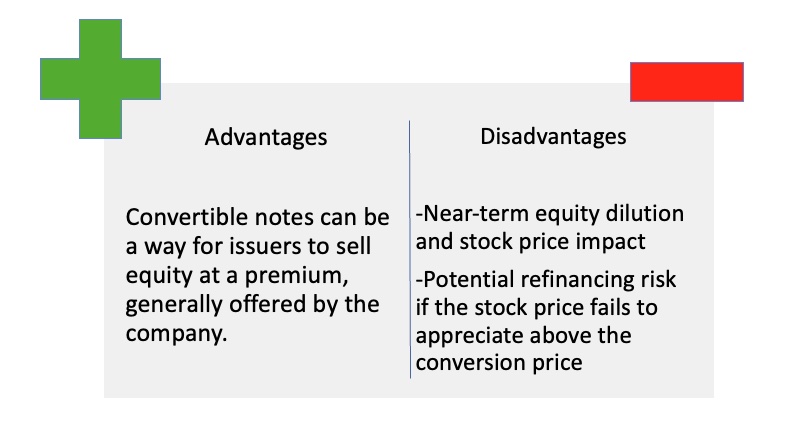

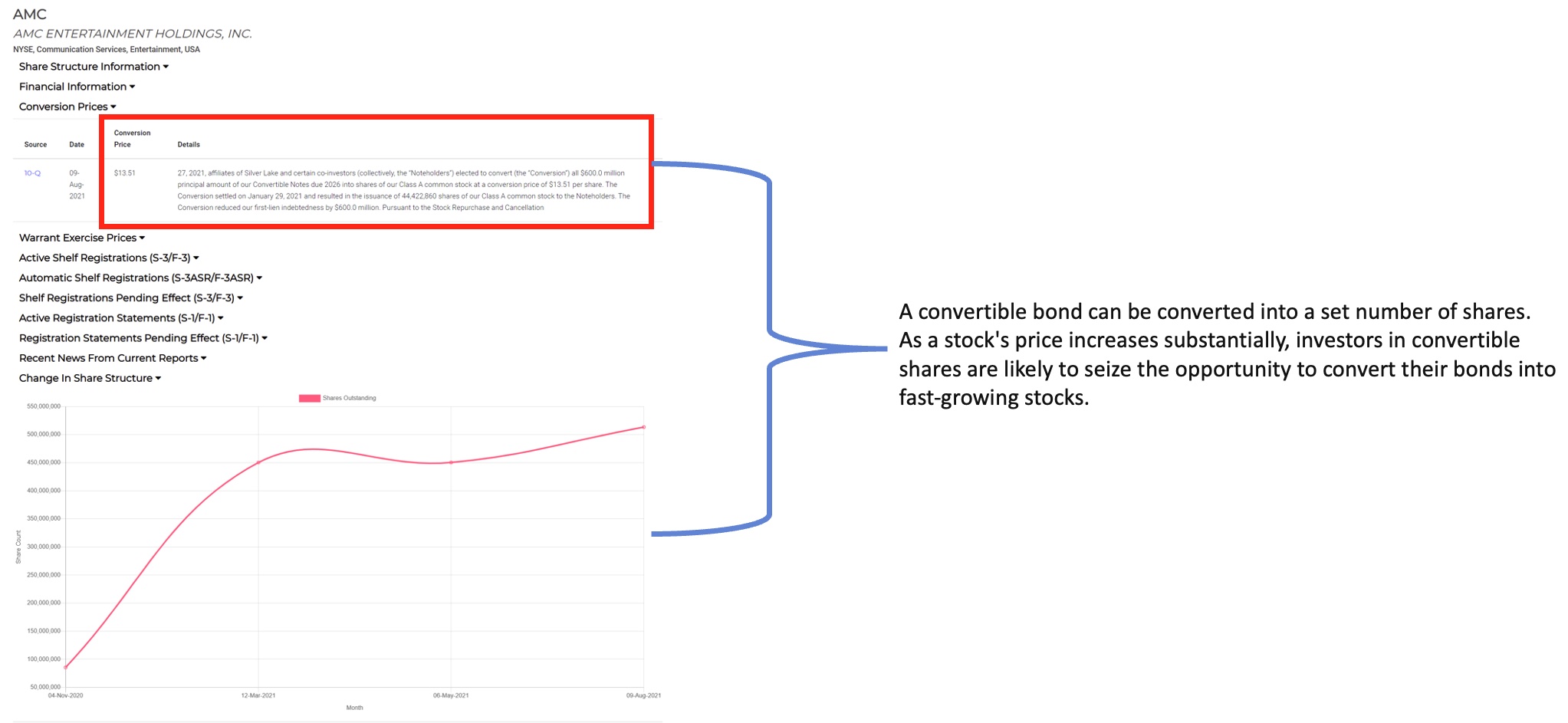

A convertible note is a debt instrument that is convertible into shares of the issuing company. Convertibles notes offer the holders the downside protection of a debt instrument and the upside appreciation potential of an equity investment. Many outstanding convertible notes include caps on the number of shares that may be issued upon conversion of the notes.

How do companies issue convertible notes?

Convertible note offerings can be conducted as:

- Registered offerings

- Unregistered private offerings

- PIPEs structured as transactions involving convertible preferred stock

Why do companies issue convertible notes?

Conversion Process

Who benefits from the conversion into equity?

- Conversion that is driven by debt holders normally benefits the investor

- Conversion that is driven by trigger event normally benefits the business

Example of dilution with convertibles notes

Senior Notes, what are they?

A senior convertible note is a debt security that contains an option in which the note will be converted into a predefined amount of the issuer's shares.

- Has priority over all other convertible securities issued by the company

- Offers investors the ability to earn interest

- Simple to execute and inexpensive for companies

- Allows for quicker access to investor funding

- Since the share amount is predefined, the issuing company may end up carrying excessive debt, which could push them into bankruptcy or inability to pay off obligations

When are convertible note offerings registered with the SEC? When will FlashSEC provide this information?

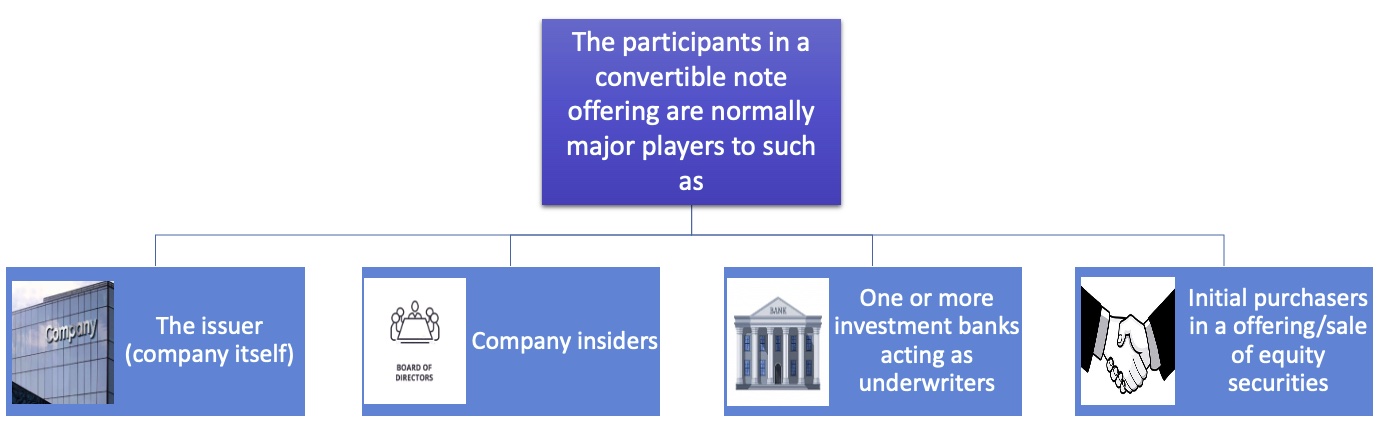

Convertible note offerings can be executed relatively quickly with little preparation, in part because they can be effected without SEC registration. FlashSEC will provide you with the most up to date status on these deals.

What needs to be filed to execute a convertible note offering?

- Primary offering document

- An underwriting

- A purchase agreement

Identifying Convertible Offerings in FlashSEC

What is Death Spiral Financing?

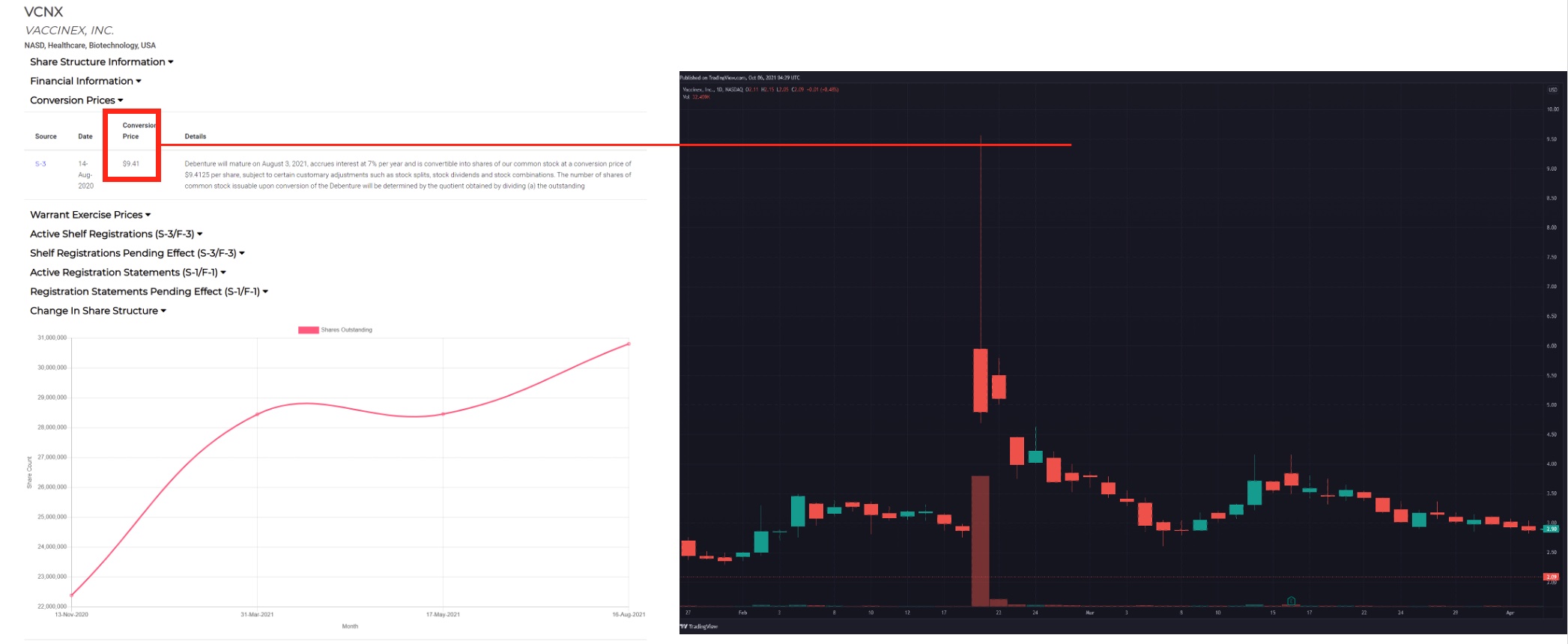

Death spiral financing is the result of a badly structured convertible financing used to fund mainly small cap companies, causing the company's stock to fall dramatically, which can lead to the company's ultimate downfall due to the forced creation of an ever-increasing number of shares, inevitably leading to a steep decline in the price of shares.

Why create Death Spiral Financing?

This type of bond may be issued by a company that desperately needs cash. A company that seeks death spiral financing probably has no other way to raise money to survive.

Mechanism of action

The death spiral effect occurs as more and more fixed-value convertible share/bond owners convert their preferred shares/debt into common stock as their value drops lower and lower. Each additional conversion will cause more price drops as the supply of shares increases, causing the process to repeat itself as the stock's price spirals downward.

As of 10/6/21, $CEI has been involved with Death Spiral Financing. $CEI Series C preferred convertibles have diluted share holders, causing their total outstanding shares and float to increase to over 200 million.

Impact of Convertibles on Price Action

A company that issues this type of convertible bond is probably desperate for cash to stay afloat. Theoretically, the death spiral effect can continue until the stock is at or near zero value.

Some investors may use convertible bonds as a component of an arbitrage opportunity, for example purchasing a convertible bond while taking a short position in the underlying common stock. This can have the effect of putting downward pressure on an issuer’s stock price at the time of a convertible note offering. Most convertible bond investors are large institutional investors and hedge funds.